News Release

BrightScope/ICI Study Analyzes Combinations of Key Features of 401(k) Plans and Trends in Plan Design

Study Taps Deep Store of 401(k) Plan Data

Washington, DC, December 22, 2015—A new in-depth study of 401(k) plans analyzes the prevalence of automatic enrollment, employer contributions, and participant loans in the plans, as well as trends in plan investment options and fees, providing new insights into the 401(k) system. The report, released today, is a collaborative effort by BrightScope and the Investment Company Institute (ICI).

The study, “The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2013,” updates the groups’ inaugural study last year, analyzing comprehensive data across a wide range of 401(k) plans. The research focuses on private-sector 401(k) plans, analyzing data from the Department of Labor on thousands of plans covering a range of plan sizes. The organizations also studied detailed investment data from the BrightScope Defined Contribution Plan Database on more 34,000 large 401(k) plans, each holding at least $1 million in plan assets and typically having 100 participants or more.

“As employers innovate in plan design, we see evidence that 401(k) plans have been evolving to offer packages of features and choices of investment options tailored to participants’ needs,” said ICI Chief Economist Brian Reid. “The study presents new, unique data to help understand how this market is evolving. Interestingly, while many employers have adopted automatic enrollment, two other attributes—employer contributions and participant loans—remain more common.”

401(k) Plans Typically Have a Combination of Activities

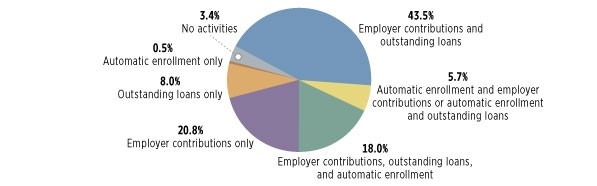

About two-thirds of 401(k) plans in a sample of nearly 54,000 large plans—those having at least 100 participants and at least $1 million in plan assets—reported evidence of at least two out of the three key plan features analyzed: automatic enrollment, employer contributions, and participant loans. The most prevalent combination was employer contributions and participant loans, observed in nearly 44 percent of the 401(k) plans in the sample. Another nearly 6 percent of the 401(k) plans had automatic enrollment combined with employer contributions, or automatic enrollment and participant loans outstanding. Eighteen percent of 401(k) plans in the sample had evidence of all three plan features. Larger plans were more likely to have all three activities in their plans.

In addition, the study found that 401(k) plans with automatic enrollment are more likely to have both employer contributions and participant loans outstanding than plans without automatic enrollment. Specifically, in the sample, nearly three-quarters of the plans with automatic enrollment in 2013 also had both of the other activities, compared with less than three-fifths of plans without automatic enrollment.

401(k) Plan Sponsors Use a Variety of Plan Designs

Percentage of 401(k) plans with selected plan activity combinations, 2013

Note: The sample is nearly 54,000 401(k) plans with 100 participants or more and at least $1 million in plan assets. See Exhibits 1.8 and A.1 in the report for additional detail.

Sources: BrightScope Defined Contribution Plan Database and Investment Company Institute tabulations of U.S. Department of Labor 2013 Form 5500 Research File

Target Date Funds Have Become More Common in 401(k) Plans Since 2006

The availability of target date funds as an investment option in 401(k)s has increased over time, according to the report. In 2006, 32 percent of 401(k) plans in the sample offered target date funds, a figure that grew to 73 percent by 2013. Similarly, the percentage of participants that were offered target date funds increased from 42 percent to 75 percent between 2006 and 2013, and the percentage of assets invested in target date funds increased from 3 percent to 15 percent during this period.

Index Funds Are Widely Available in 401(k) Plans

The study shows that nine in 10 401(k) plans in the sample offered index funds in 2013. That year, more than 95 percent of plans with assets of more than $50 million offered these funds in their plan menus, compared with about 85 percent of 401(k) plans with $1 million to $10 million. In addition, index funds made up a significant component of 401(k) plan assets, holding more than a quarter of 401(k) plan assets in 2013.

Mutual Fund Fees, Total Plan Cost Have Trended Down

Mutual fund fees in 401(k) plans tended to fall between 2009 and 2013. Consistent with other research, the study also found that fund expenses are typically lower in larger plans. For instance, the average asset-weighted expense ratio for domestic equity mutual funds was 0.81 percent for plans with $1 million to $10 million in plan assets, compared with 0.44 percent for plans holding more than $1 billion in plan assets. A fund expense ratio is total costs as a percentage of assets.

“A variety of factors contribute to the downward trend of both 401(k) total plan costs and the fees of mutual fund in the plans—including continued awareness and focus by plan sponsors and plan participants on the impact of fees on 401(k) savings,” said Brooks Herman, head of data and research at BrightScope. “Our comprehensive database with extensive details on plans’ investments continues to help advance that awareness.”

BrightScope’s measure of 401(k) total plan cost includes asset-based investment management fees, asset-based administrative and advice fees, and other fees reported by a wide cross-section of 401(k) plans. Whether measured for the average 401(k) plan, the average participant, or the average dollar, total plan costs also have decreased over time. For example, total plan cost fell from 1.02 percent of assets in the average 401(k) plan in the BrightScope database in 2009 to 0.89 percent of assets in 2013. In 2013, the average participant was in a 401(k) plan with a total plan cost of 0.58 percent of assets, compared with 0.65 percent in 2009.