Mutual Fund Investors Represent Wide Range of Ages and Income Levels

Shareholders trust funds to help them save for retirement

Washington, DC; November 20, 2018—Individuals across all income levels and generations own mutual funds, according to new survey results released today by the Investment Company Institute (ICI). Nearly half of mutual fund–owning households surveyed had household incomes of less than $100,000.

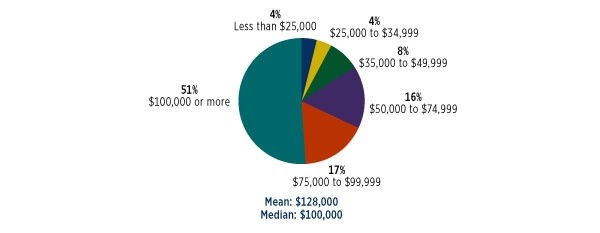

The survey results, released in two studies—“Ownership of Mutual Funds, Shareholder Sentiment, and Use of the Internet, 2018” and “Characteristics of Mutual Fund Investors, 2018”—find that 16 percent of mutual fund–owning households had household incomes lower than $49,999, 16 percent had household incomes of $50,000 to $74,999, and 17 percent had household incomes of $75,000 to $99,999. The remaining 51 percent of mutual fund–owning households surveyed reported household incomes of $100,000 or more.

“Our 2018 household survey shows that savers across all income levels continue to invest in mutual funds,” said Sarah Holden, ICI senior director of retirement and investor research. “These data help underscore the critical role mutual funds play in helping millions of US households save and prepare for retirement and other important financial goals.”

Mutual Fund Owners Represent Many Different Income Groups

Percentage of US households owning mutual funds, 2018

Note: Total reported is household income before taxes in 2017.

Source: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey

Mutual Fund Ownership Spreads Across All Generations

The study also showed that mutual fund ownership is most prevalent among Generation Xers and Baby Boomers. In 2018, 52 percent of the 35.0 million households headed by a member of Generation X owned mutual funds, 46 percent of the 42.5 million households headed by a Baby Boomer owned mutual funds, and 38 percent of the 33.2 million households headed by a Millennial owned mutual funds. Households headed by Baby Boomers accounted for 34 percent of mutual fund–owning households, while households headed by a member of Generation X or a Millennial accounted for 32 and 23 percent of mutual fund–owning households, respectively.

Other Key Survey Findings Include:

- In 2018, 44.8 percent of US households owned shares of mutual funds or other US-registered investment companies—including exchange-traded funds, closed-end funds, and unit investment trusts—representing an estimated 57.2 million households and 101.6 million investors. Mutual funds were the most common type of investment company owned, with 43.9 percent of US households owning mutual funds in 2018. The survey also found that 99.5 million individual investors owned mutual funds in 2018.

- Millennial households owning mutual funds are more likely to hold funds inside employer-sponsored retirement plans, compared with older generations. In 2018, 47 percent of Millennial households owning mutual funds held their funds only through employer-sponsored retirement plans. By comparison, 33 percent of mutual fund–owning Baby Boom households held funds only through employer-sponsored retirement plans.

- Mutual fund–owning households often held several funds, and equity funds were the most commonly owned type of mutual fund. Among households owning mutual funds in 2018, 82 percent held more than one mutual fund; 88 percent owned equity funds.

About the Annual Mutual Fund Shareholder Tracking Survey

ICI conducts the Annual Mutual Fund Shareholder Tracking Survey each year to gather information on the demographic and financial characteristics of mutual fund–owning households in the United States. The most recent survey was conducted from May to July 2018 and was based on a dual frame telephone sample of 5,001 US households. Of these, 2,251 households were from a landline random digit dial (RDD) frame and 2,750 households were from a cell phone RDD frame. Of the households contacted, 2,196 (43.9 percent) owned mutual funds. All interviews were conducted over the telephone with the member of the household who was either the sole or the co-decisionmaker most knowledgeable about the household’s savings and investments. The standard error for the 2018 sample of households owning mutual funds is ± 2.1 percentage points at the 95 percent confidence level.

Supplemental tables for “Ownership of Mutual Funds, Shareholder Sentiment, and Use of the Internet, 2018” and “Characteristics of Mutual Fund Investors, 2018” can be found on ICI’s website.