Americans Appreciate Structure and Features of Defined Contribution Plans

Washington, DC; February 23, 2021—The majority of Americans are confident that 401(k)s and other defined contribution (DC) retirement accounts can help meet their retirement goals, according to an updated study released today by the Investment Company Institute (ICI).

The study, American Views on Defined Contribution Plan Saving, 2020, found that 76 percent of Americans had favorable impressions of 401(k) and similar retirement plan accounts in fall 2020. Americans also generally had confidence in DC plan accounts. Confidence in DC plan accounts was highest among individuals whose households owned DC accounts or individual retirement accounts (IRAs), with 83 percent indicating that they were confident the accounts could help people meet their retirement goals. Seventy percent of individuals who did not own either DC accounts or IRAs expressed confidence that DC plan accounts can help people meet their retirement goals.

“Time and again, this research finds that Americans appreciate and benefit from the key features offered by DC plans, making them popular and powerful retirement savings vehicles,” said Sarah Holden, ICI senior director of retirement and investor research. “Survey respondents report that payroll deduction of contributions makes it easier for them to save, while the flexibility, control, and access to a good lineup of investment options that these plans offer give these savers the opportunity to invest to build their retirement nest egg.”

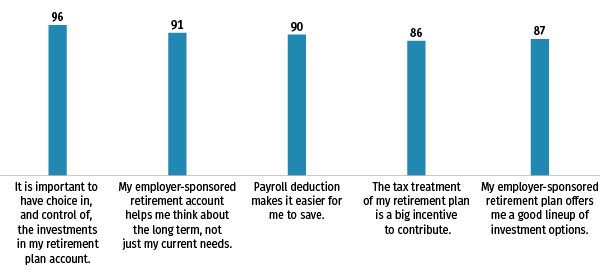

According to the survey, DC-owning individuals particularly appreciate the saving and investing features of DC plans. More than nine in 10 individuals with DC accounts (91 percent) agreed that these plans encourage them to think about the long term, and nine in 10 agreed that payroll deduction makes it easier to save for retirement. Most individuals with DC accounts (96 percent) agreed that it is important to have a choice in, and control of, the investments in their DC plan accounts and 87 percent of DC-owning individuals appreciate the array of investment options that their employer-sponsored retirement plan offers them. Meanwhile, almost half indicated that they probably would not be saving for retirement if not for their DC plans at work.

DC Account Owners Appreciate Savings and Investment Features

Percentage of DC-owning individuals* agreeing with each statement

*DC-owning individuals are individuals aged 18 or older whose households owned 401(k) plan accounts or other DC plan accounts at the time of the survey.

Note: The figure reports the percentage of DC-owning individuals who “strongly agreed” or “somewhat agreed” with the statement. The remaining respondents “somewhat disagreed” or “strongly disagreed.”

Source: ICI tabulation of NORC AmeriSpeak® survey data (fall 2020)

Americans Oppose Changing Important Tax Features of DC Plan Accounts

The survey also found that a strong majority of Americans disagree with potential changes affecting current tax features of DC plans. In fall 2020, 87 percent of survey respondents disagreed that the government should take away tax advantages of DC accounts. Eighty-nine percent of all individuals surveyed disagreed with reducing the amount that individuals can contribute to DC accounts, showing that support for the tax treatment of these accounts is common even among those who do not currently have DC accounts or IRAs. According to the survey, 79 percent of individuals without DC accounts or IRAs also rejected the idea of taking away the tax treatment of DC accounts, further reinforcing the notion that Americans strongly support retaining this core incentive for saving through DC plans.

About the Survey

The study summarizes results from a nationally representative survey of American individuals aged 18 or older. Respondents were asked about their views on DC retirement account saving, their reactions to proposed policy changes, and their confidence in 401(k) and other DC plan accounts. The survey was conducted using the AmeriSpeak® research panel, a probability-based panel designed and operated by NORC at the University of Chicago.

For more information about retirement saving, please visit ICI’s 401(k) Resource Center Individual Retirement Account Resource Center.