ICI Viewpoints

How Do ETF and Mutual Fund Investors Differ?

Like the products themselves, exchange-traded fund (ETF) and mutual fund investors share many commonalities. In fact, most ETF-owning households also own mutual funds, using both vehicles to achieve similar goals. However, recent ICI survey data shed light on some important differences in the profiles of ETF and mutual fund owners and their implications for the investment industry.*

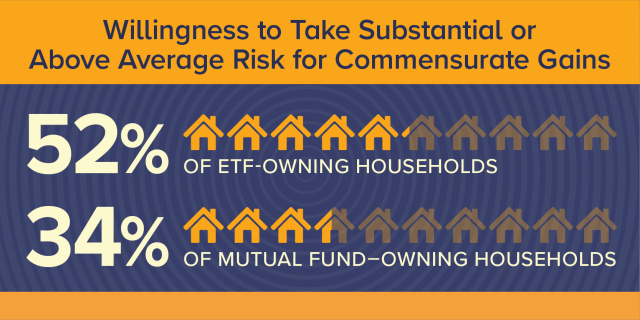

Risk Tolerance

ETF and mutual fund owners differ in their risk appetites, according to the survey responses. More than half of ETF-owning households are willing to take substantial or above average investment risk for commensurate gains, compared with about one-third of mutual fund–owning households. Nevertheless, both groups value diversification and review investment objectives and risks when selecting funds, implying a strategic approach to investing.

Age Differences and Tax Considerations

While mutual fund ownership tends to rise with household age, ETF ownership rates vary little across age cohorts. Where those funds are acquired and held, however, shifts similarly along the age spectrum within both groups of investors. As with their mutual fund−owning counterparts, older ETF-owning households are more likely than younger ones to hold ETFs inside individual retirement accounts (IRAs).

Among ETF owners, younger households are more likely to purchase their ETFs directly through fund companies or discount brokers, while older households are more likely to buy them through independent financial advisers. In contrast, direct access varies little by age across mutual fund−owning households.

Households that own ETFs are as likely to hold them in tax-advantaged IRAs as in taxable accounts, suggesting that these investors favor ETFs for more than just their potential tax efficiencies. Mutual fund−owning households, by comparison, are much more likely to hold mutual funds in tax-deferred accounts, such as IRAs, 401(k) plans, and variable annuities, than in taxable accounts.

Shared Priorities but Varied Emphasis

Both groups primarily use funds to save for retirement. Furthermore, ETF and mutual fund owners are generally like-minded in the benefits they seek when selecting funds. However, they value those benefits to varying degrees.

For instance, 51 percent of ETF-owning households indicate that cost effectiveness is very important, versus 44 percent of mutual fund−owning households. Professional management was somewhat less important to ETF-owning households—68 percent agreed it was very or somewhat important compared with 79 percent for mutual fund−owning households. This difference possibly reflects the dominance of indexing among ETFs and the more prevalent role of active management in the mutual fund universe.

Notably, ETF-owning households greatly appreciate the ability to trade ETFs intraday, a feature mutual funds cannot offer. Roughly seven out of 10 ETF-owning households indicate such flexibility is very or somewhat important.

A Vibrant and Competitive Fund Market

While their exact preferences differ somewhat, ETF and mutual fund owners report having shared investment goals and priorities, researching the funds they select. Together, these investors play an important part in a healthy and competitive marketplace, impelling the industry to innovate and expand the range of professionally managed, diversified, and cost-effective funds available to meet their specific needs.

Note

* ICI’s latest Annual Mutual Fund Shareholder Tracking Survey, which gathers information on the demographic and financial characteristics of US households that own mutual funds and/or ETFs, was conducted from May to June 2022 and fielded on the KnowledgePanel®, a probability based online panel designed to be representative of the US population. The KnowledgePanel® is designed and administered by Ipsos. Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing over 18,000 people. The Annual Mutual Fund Shareholder Tracking Survey for 2022 included 6,080 randomly selected US households drawn from the KnowledgePanel®. Of the households contacted, 746 (12.3 percent) owned ETFs. The overall margin of sampling error for the 2022 sample of US households owning ETFs is ± 3.6 percentage points at the 95 percent confidence level. For additional detail on the survey, see “Ownership of Mutual Funds and Shareholder Sentiment, 2022.” For additional information on the financial and demographic characteristics of ETF-owning households, see “Profile of ETF-Owning Households, 2022.”

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.

Daniel Schrass is an Economist at ICI.