ICI Viewpoints

Get a Closer Look at Closed-End Funds

ICI has recently updated several of its key closed-end funds resources. Closed-end funds are a type of investment company that generally issues a fixed number of shares that are listed on a stock exchange or traded in the over-the-counter market. Ranging from the basics to more-complex topics, the resources should be helpful for anyone interested in these funds:

- A Guide to Closed-End Funds: What are the features of closed-end funds? How do they calculate the value of their portfolios? This guide answers these questions and more.

- Frequently Asked Questions About Closed-End Funds and Their Use of Leverage: These FAQs delve into “leveraging,” the practice whereby a closed-end fund raises additional capital, which it can use to buy more securities for its portfolio. This strategy is intended to allow the fund to produce higher returns for its common shareholders over the long term.

Closed-End Fund Assets: Recent Trends

Don’t forget ICI’s recent report on closed-end funds, which goes into detail on the closed-end fund market, the funds themselves, and the characteristics of their investors.

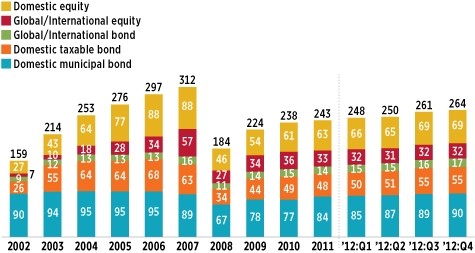

As the report indicates, total closed-end fund assets were $264 billion at year-end 2012, up 9 percent from year-end 2011.

Closed-End Fund Total Net Assets Increased to $264 Billion at Year-End 2012

Closed-end fund total net assets by investment objective; billions of dollars; year-end; 2002–2011, 2012:Q1–2012:Q4

Note: Components may not add to the total because of rounding. Data reflect revisions to previously reported data.

Source: Investment Company Institute

Visit our Closed-End Fund Resource Center to find the report and other useful information.

Daniel Schrass is an Economist at ICI.